Insurance Research Strategy

My role as Digital Experience Manager involved establishing a user experience strategy to inform decisions, enhance products, and ensure alignment with user needs.

Overview

Pekin Insurance embarked on a digital transformation to improve customer and agent experiences. The focus was on creating a foundation for research-driven design, improving accessibility, and fostering innovation across digital products like customer portals and agent tools. The strategy I implemented laid the foundation for a digital transformation that improved usability, accessibility, and operational efficiency, while fostering a collaborative culture where user insights drove meaningful change.

Some information in this case study may be changed to protect confidential or private information. All information and views presented in this case study are my own and do not reflect the views of Pekin Insurance.

The Challenge

Pekin Insurance was facing challenges with outdated digital platforms that struggled to meet the evolving expectations of agents and insured customers. These gaps weren’t just technical. They reflected a deeper disconnect between user needs and business priorities. As the Digital Experience Manager, I led the charge to redefine the company’s approach through a digital experience strategy, which incorporated establishing a UX research practice. This effort wasn’t just about modernizing, it was about transforming the company’s mindset to embrace user-centered practices as a catalyst for innovation.

How might we establish a user research strategy to identify user pain points, improve product usability, and support a user-centered digital transformation?

Goals

- Identify key pain points in the customer and agent experiences.

- Develop a research-driven roadmap for portal redesigns and new features.

- Ensure accessibility compliance and improved usability for diverse user groups.

- Create a DX strategy to foster a user-centered culture within the organization using mixed-methods research.

Solution

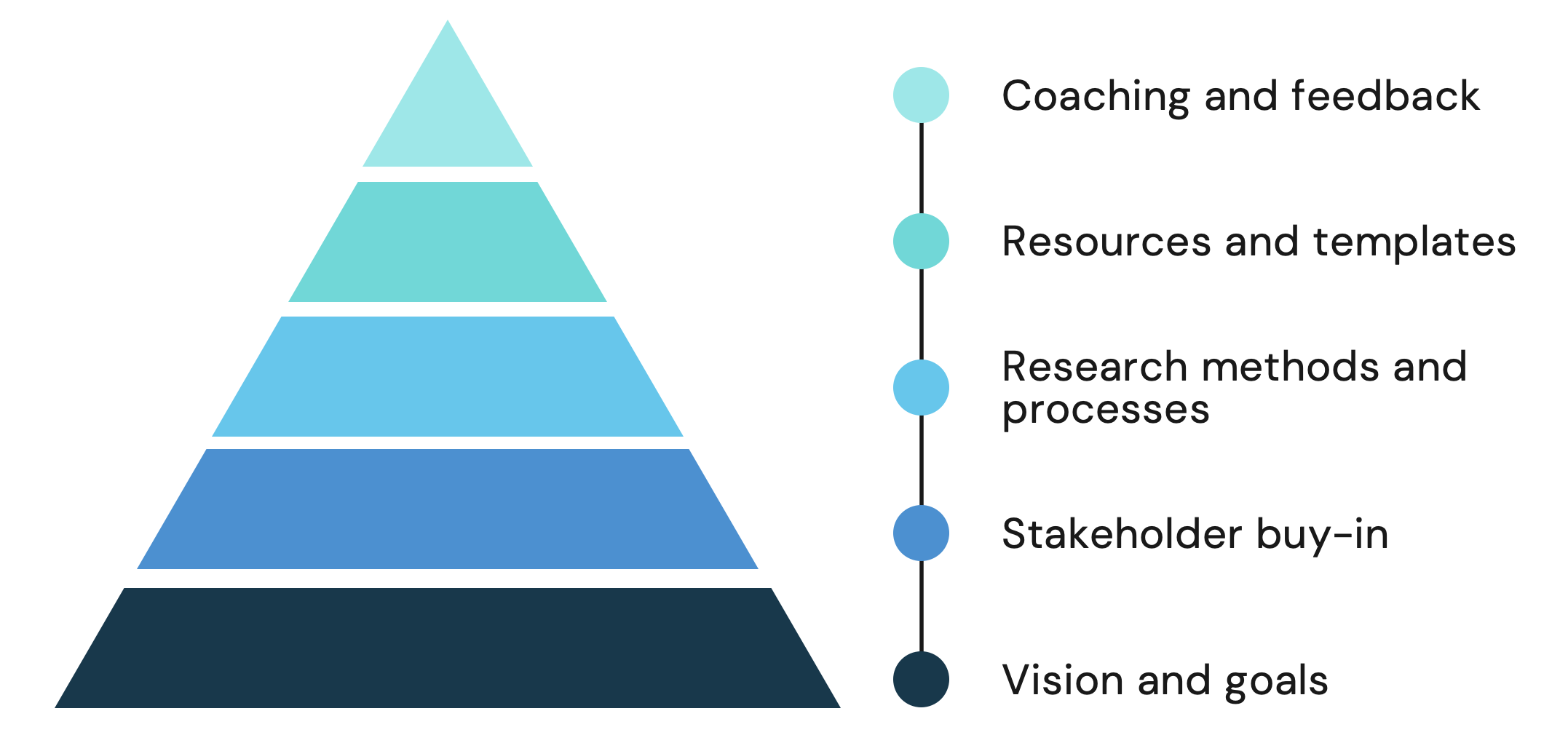

The digital transformation at Pekin Insurance began delivering tangible results, marking significant progress in improving user experiences for both agents and insured customers. To ensure continued improvement, I established a UX research frameworkthat focused on usability evaluations, accessibility testing, and standardized processes for collecting and analyzing data.

- Set a clear vision and goals

- Ensure stakeholders are updated frequently and involved in decision making

- Establish and guide research methods and processes

- Standardized test scripts and logs to ensure consistent data collection through resources and templates

- Regular coaching, mentoring, and feedback to upskill team members in research methods

Impact: This framework ensured that data-driven insights continued to improve usability and accessibility across digital products.

Research Process

The transformation was guided by a structured, iterative approach, ensuring that every step was grounded in research and aligned with business outcomes.

Discover

Conducted in-depth mixed-methods research

Using interviews, workshops, competitive analysis, data analysis, and workflow mapping to uncover the pain points impacting agents and customers. Insights ranged from usability challenges to gaps in technical integration.

Define

Synthesized research findings into actionable opportunities

Prioritized them based on organizational goals. Created service blueprints and journey maps that highlighted friction points and opportunities to align systems, processes, and tools with user needs.

Sustain

Established a research framework

Empowered teams to continue iterating on user insights. Focused on mentoring team members and embedding a culture of research to ensure sustainability beyond my tenure.

Internal Interviews

To understand the full landscape of user interactions, I conducted interviews across underwriting, claims, helpdesk, and other business areas. These conversations provided a nuanced understanding of how agents and insured customers interact with the company and highlighted internal perceptions about customer experience.

Agents were seen as "the real customers" by internal teams due to their role in generating revenue and being supported by IT and business initiatives.

Insured customers, skewing more senior (55+) and residing in rural areas, often faced challenges with unsupported legacy apps and limited digital tools.

There was hesitancy to engage directly with insured customers, with concerns that it might create tension with agents.

Impact: These insights highlighted a significant gap in how the organization prioritized user groups, shaping the need for equitable solutions that addressed both agent and insured pain points.

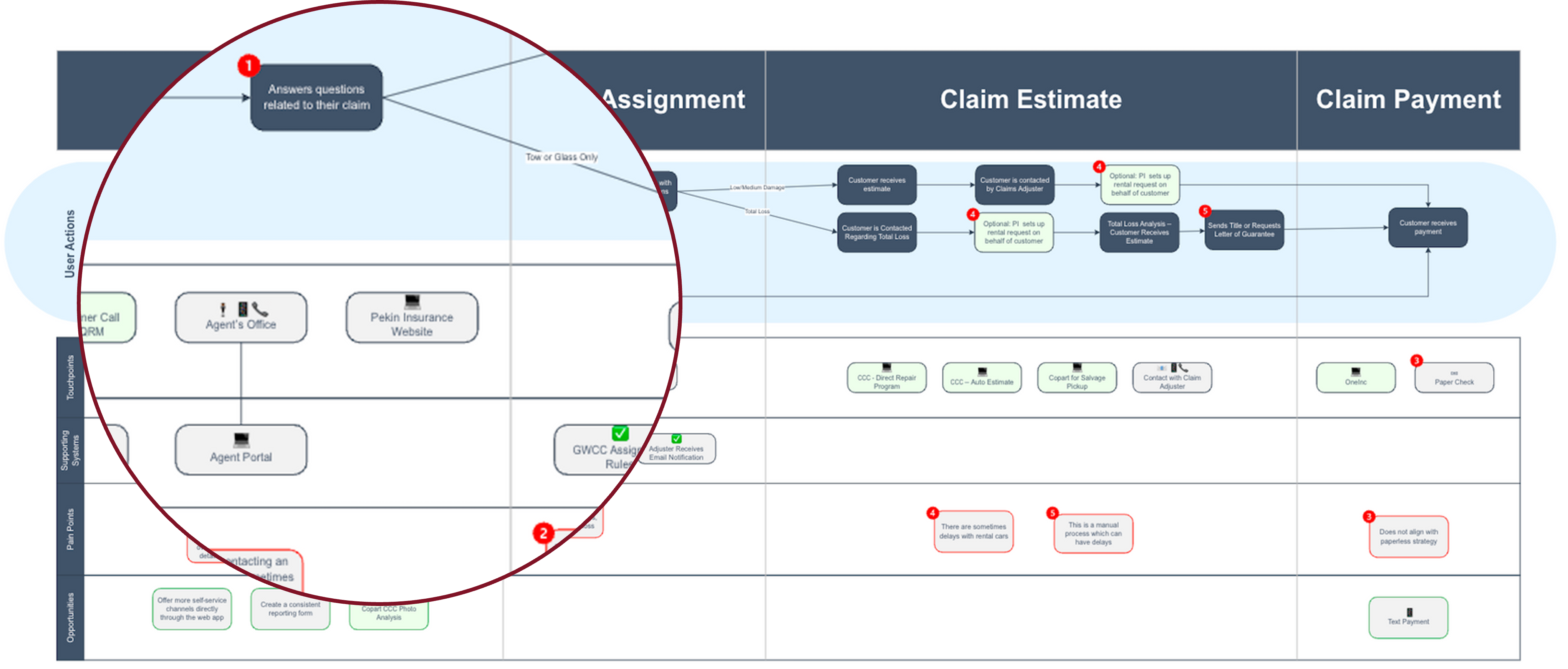

Service Design

Collaborating with the claims team, I developed a service blueprint to map the end-to-end claims journey. This exercise identified friction points, such as:

- Delayed communication between agents and claims representatives, leading to longer resolution times.

- Inconsistent reporting tools that added confusion to the process.

- Reliance on manual workflows, causing inefficiencies at multiple touchpoints.

Outcome: The blueprint provided a clear visualization of the claims process, pinpointing opportunities for automation, streamlined communication, and improved user flows.

Customer Interviews

Building trust with agents was critical for uncovering the real challenges they faced. Through interviews conducted by office visits and phone calls, I learned how their frustrations with existing tools impacted their ability to serve insured customers.

- Agents often relied on their own tools, bypassing our systems.

- Agents expressed a strong desire for more self-service capabilities for customers, especially for - processes like Claims, where they are the middle person between the customer and the company.

- Agents voiced skepticism in the company’s ability to build reliable digital solutions.

- Many agents were eager for Pekin to align with modern industry standards.

Impact: These candid insights reinforced the importance of addressing usability and reliability issues while demonstrating to agents that their feedback was valued.

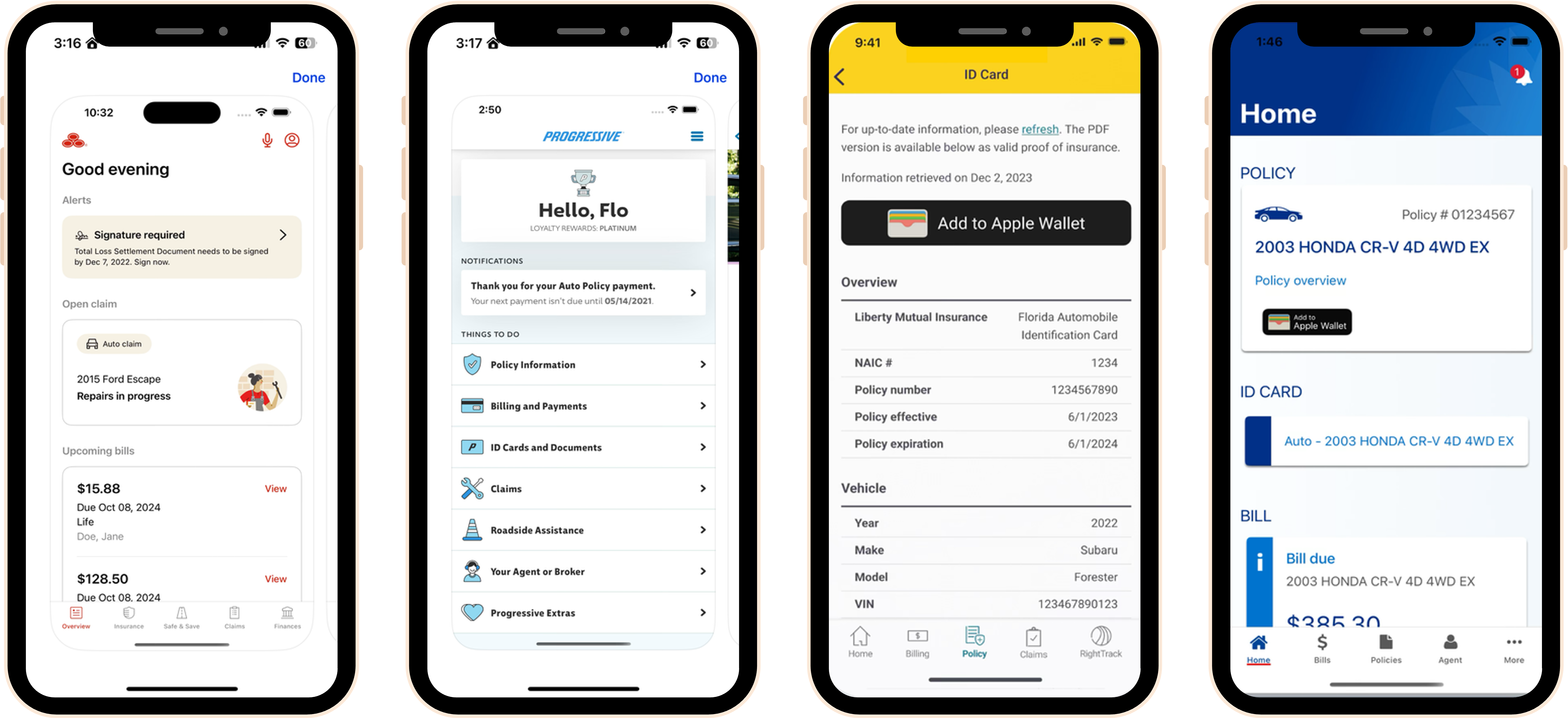

Competitive Analysis

Competitive Analysis To benchmark against industry standards, I conducted a thorough competitive analysis of digital solutions from major players like State Farm, Progressive, Liberty Mutual, and American Modern. This review helped identify best practices and gaps in Pekin Insurance’s offerings.

- Modern insurance apps provided personalized dashboards, self-service capabilities, and integrated tools for policy management and claims tracking.

- Competitors heavily prioritized mobile accessibility, reflecting the growing importance of on-the-go interactions.

Impact: These insights established a baseline for user expectations, shaping the vision for an improved digital experience that prioritized seamless, self-service functionality.

Ticket Analysis

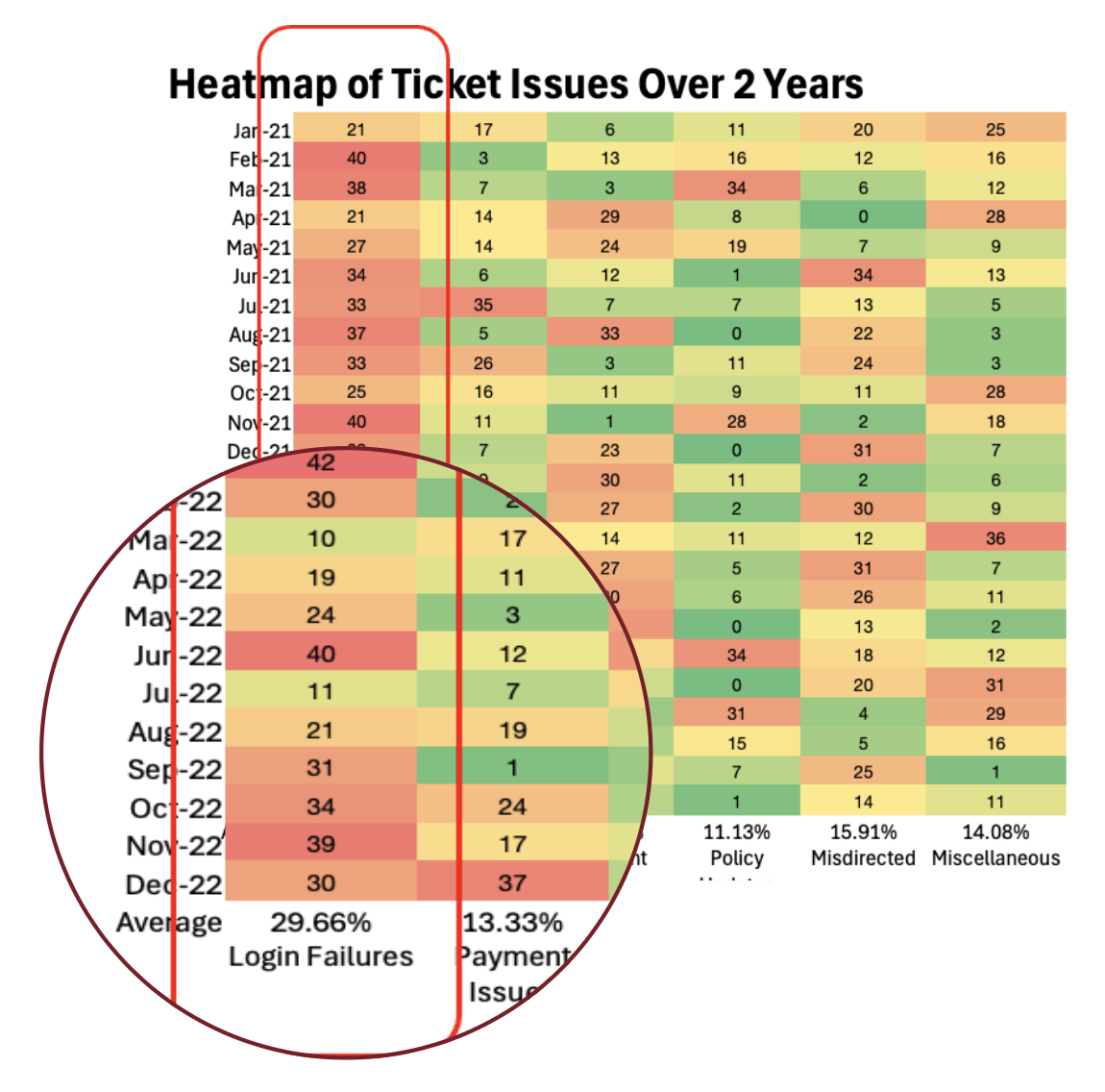

It was clear that data was hard to come by as analytics tools were used minimally. By analyzing two years’ worth of support tickets, I identified recurring pain points that directly impacted user satisfaction and operational efficiency.

Heatmapping

- 29% of tickets were related to login failures, reflecting technical debt and outdated authentication processes.

- 16% were misdirected, indicating unclear guidance and possible internal process improvement opportunities.

- The data revealed a persistent lack of intuitive design, leading to reliance on human support for tasks that should be self-service.

Impact: These findings informed immediate priorities for the digital transformation roadmap, including enhanced login experiences and clearer navigation paths.

Outcomes

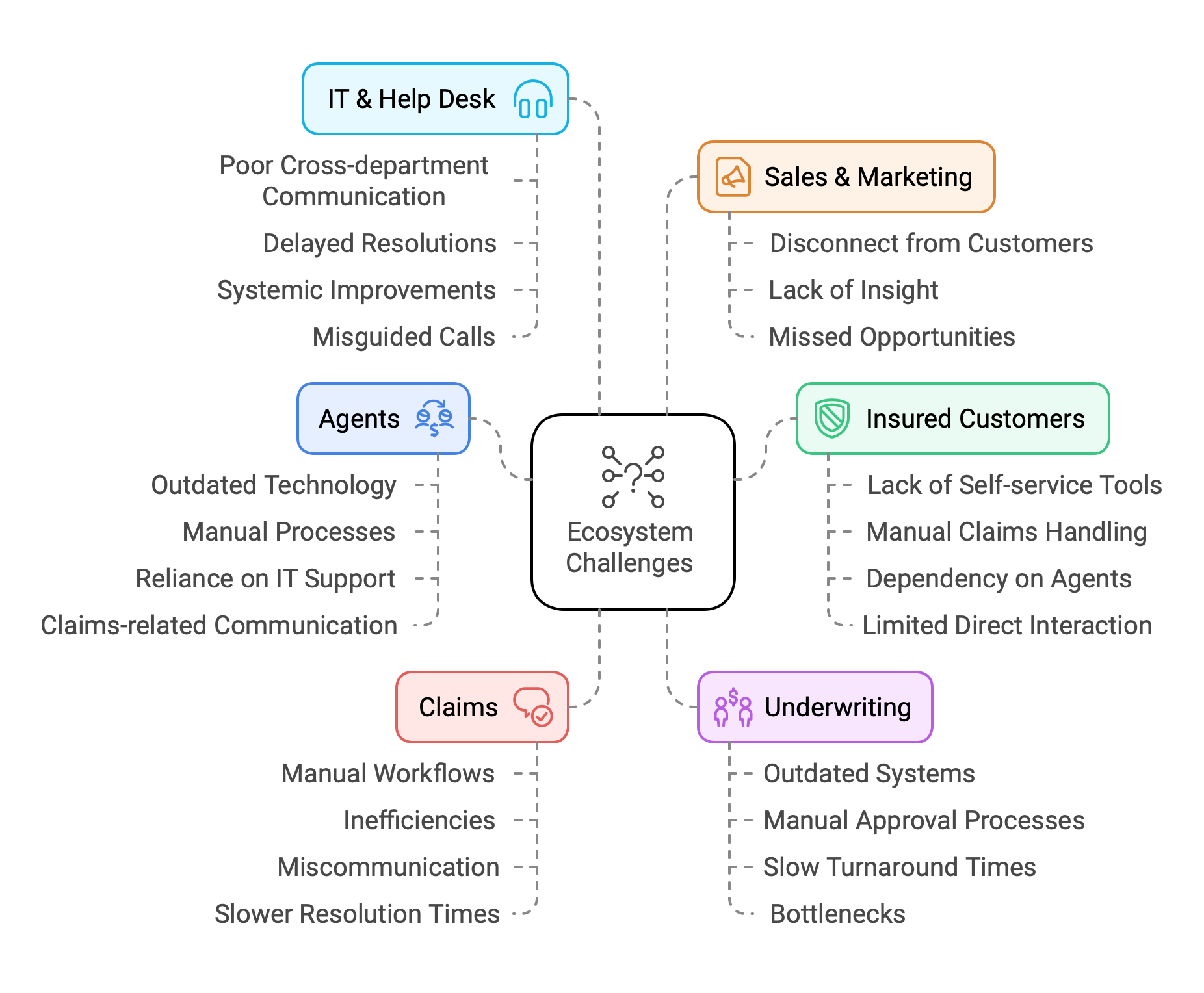

Using context mapping, I visualized relationships and dependencies between insured customers, agents, and internal business functions like claims, underwriting, and IT. This exercise highlighted systemic issues.

Outcome: The map clarified areas where improved communication and automation could deliver the most value, enabling cross-functional alignment.

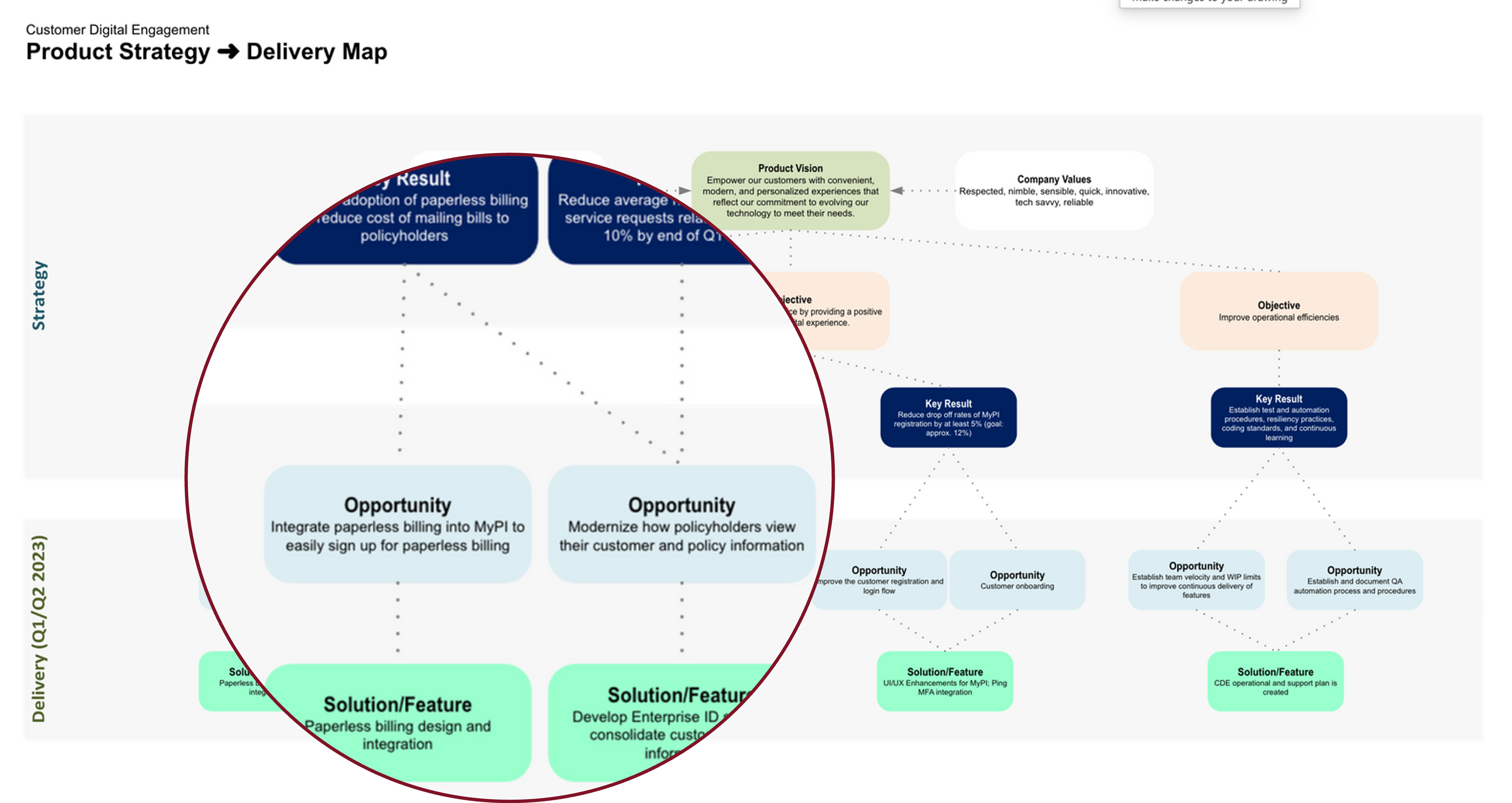

Delivery Mapping

I designed a strategy-to-delivery map to align company goals, department objectives, and measurable outcomes. The map connected opportunities and solutions to strategic initiatives, emphasizing self-service improvements and operational efficiencies.

Key Elements

- Defined top-level strategies and linked them to actionable objectives.

- Identified key opportunities, like paperless billing integration and agent onboarding optimization.

- Outlined measurable outcomes, such as cost savings and improved task success rates.

Impact: This framework enabled leadership and the team to visualize how strategic goals were directly supported by tactical initiatives.

Tactical Roadmap

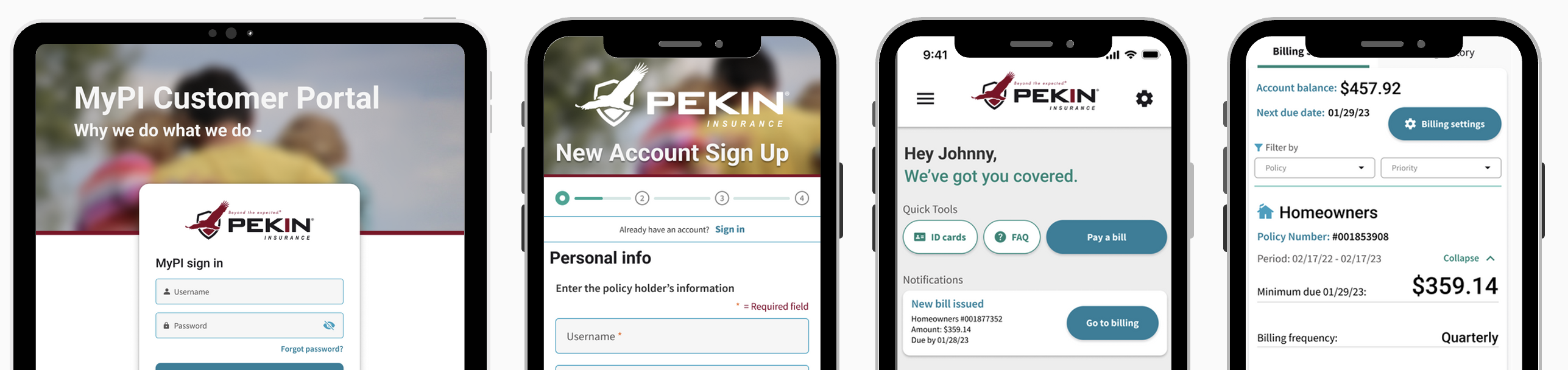

Based on the findings from research and discovery, I developed a tactical roadmap to prioritize features for the MVP and subsequent releases (R1, R2).

MVP & Iterations

- MVP: Integrated modern authentication, created enterprise customer records, and introduced a modern payment solution.

- R1: Implemented paperless billing, claims status tracking, and digital wallet ID cards.

- R2: Introduced forms for commercial and life insurance as well as first notice of loss features.

Impact: This phased approach maximized immediate value while ensuring long-term sustainability and growth.

Impact

The digital transformation at Pekin Insurance began delivering tangible results, marking significant progress in improving user experiences for both agents and insured customers.

- Fixed and enabled over 90 new agency user experience features in 6 months. This effort showed a commitment to addressing user pain points and drastically improved user experience feedback from agents. This enabled the organization to decide to open up a previously closed line of business, generating more business.

- On-track to launch the new customer portal by year-end 2024. This initiative not only enhances the overall user experience but also positions the company to save $5M annually by improving operational efficiency and reducing support costs.

- Claims team innovations. By implementing new processes and technologies, the claims team was better equipped to support customers, reducing friction in critical workflows in their solutions.

- Alignment with organizational strategy. Every UX effort directly supported business objectives, such as cost savings, operational efficiencies, and enhanced customer satisfaction.

To showcase these improvements, the portal redesign includes intuitive self-service tools, clear navigation, and modern features that align with customer expectations. The new design prioritizes accessibility, usability, and efficiency, providing a seamless experience across devices.